how to reduce taxable income for high earners australia

The biggest and best way weve seen highly paid high functioning people reduce their tax is through changing the way they get paid. 50 Best Ways to Reduce Taxes for High Income Earners.

Change the way you get paid.

. How do high-income earners reduce taxes in Australia. Salary sacrifice is one method for learning how to save tax in Australia. Gifts and donations to charitable organizations are one of the most common tax reduction strategies for high-income earners because they create a win-win.

Using a Discretionary Trust to reduce taxes. Operate salary sacrifice. If you are an employee.

Set up a discretionary trust. You can contribute up to 6000 per year if youre under 50 years old and up to 7000 if youre 50 or. High earners can reduce taxable income in many ways.

Maximizing all of your. The Fed continues to. If youre a high-income earner in Australia it is wise to implement a tax minimization strategy.

Here are 50 tax strategies that can be employed to reduce taxes for high income earners. To encourage middle to high-income earners to reduce their dependability on the public health system and make the private healthcare industry more sustainable. The amount youre allowed to contribute depends on your income.

With a daf you can make a donation receive an immediate tax deduction and then recommend grants to be given from. This is a tax-effective strategy because super contributions. Salary sacrificing into super involves forgoing some of your pre-tax salarywages and putting it into super instead.

We review the basics and introduce you to new tactics such as tax loss carryforward. Jane earns 230000 salary per year and has 2 adult children of 19 and 18. Our extensive amount of experience and.

Invest in Companies that Pay Dividends. An easy way to avoid paying this for high-income earners is by acquiring private health insurance hospital cover making it an easy way to reduce tax. Both are studying and will continue education for another 5.

At Valles Accountants we have worked with countless high income earners to effectively reduce their tax through a variety of different methods. How To Reduce Taxable Income For High Earners 2020. This is known as salary packing and it operates in a variety of ways.

The income that you earn from your job is taxed at ordinary income rates and the result is that you pay a high tax rate if you are a high.

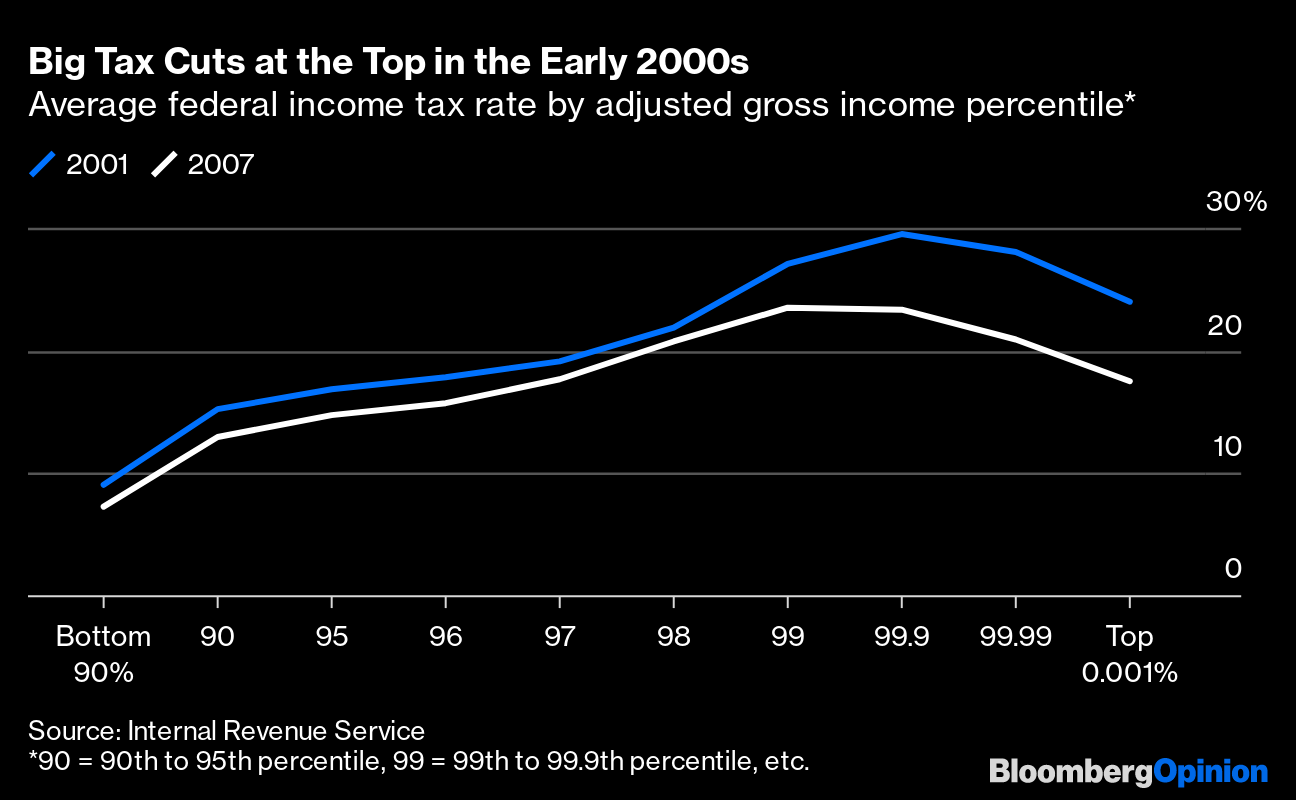

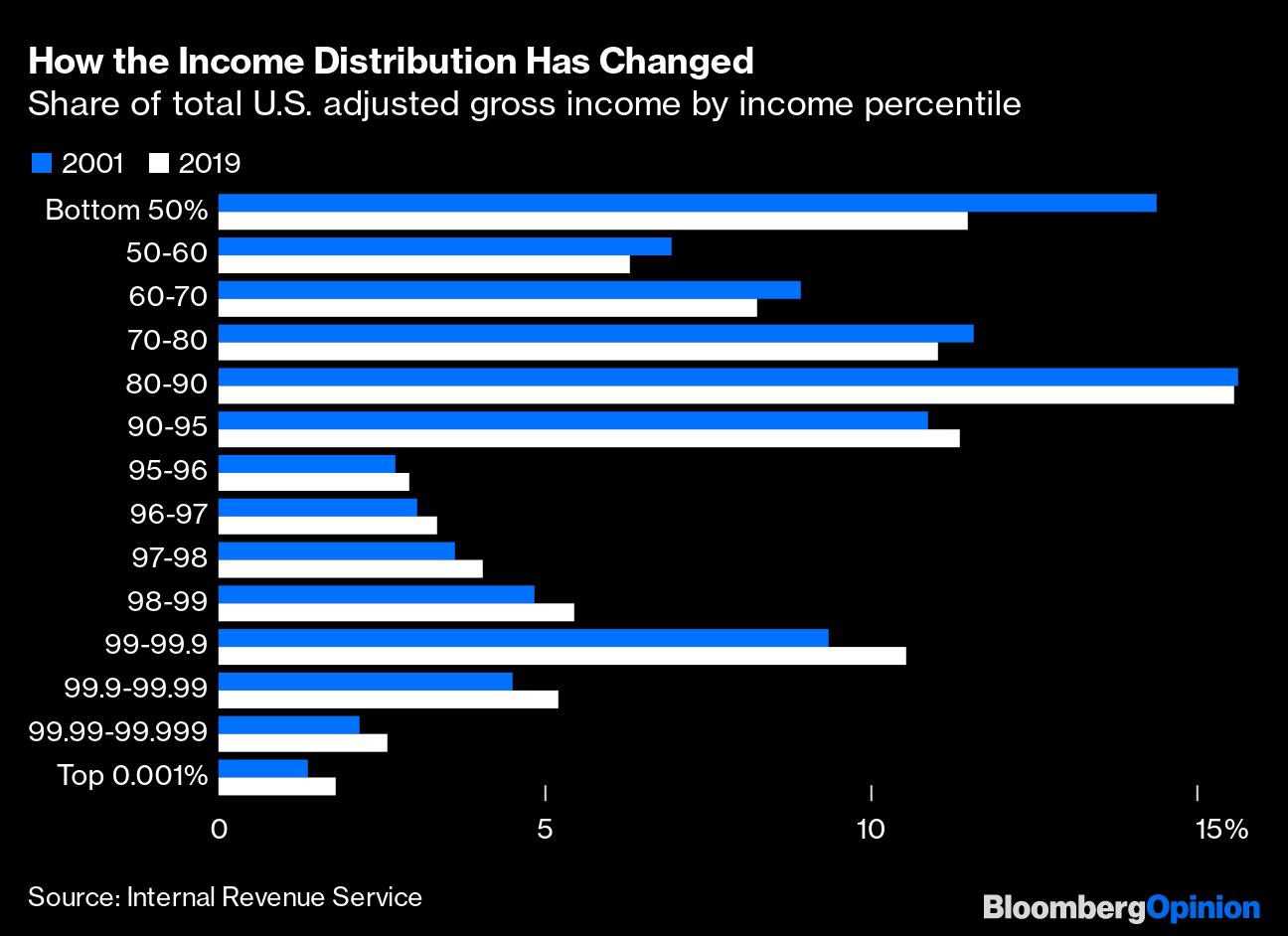

U S Income Tax Policy Is Mostly About The 1 Bloomberg

Tax Penalties For High Income Earners Financial Samurai

Advanced Tax Strategies For High Income Earners In Australia Solve Accounting

Taxing The 1 Why The Top Tax Rate Could Be Over 80 Cepr

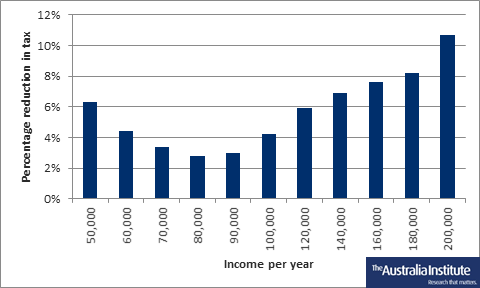

The Whole Of The Government S Income Tax Plan Has Passed The Parliament So What Does That Mean By The Australia Institute Medium

Fifteen Ways To Reduce Your Tax Bill Financial Times

How Regular People Can Pay Less Taxes Like The Rich And Powerful

Tax Reduction Strategies For High Income Earners 2022

Taxation In New Zealand Wikipedia

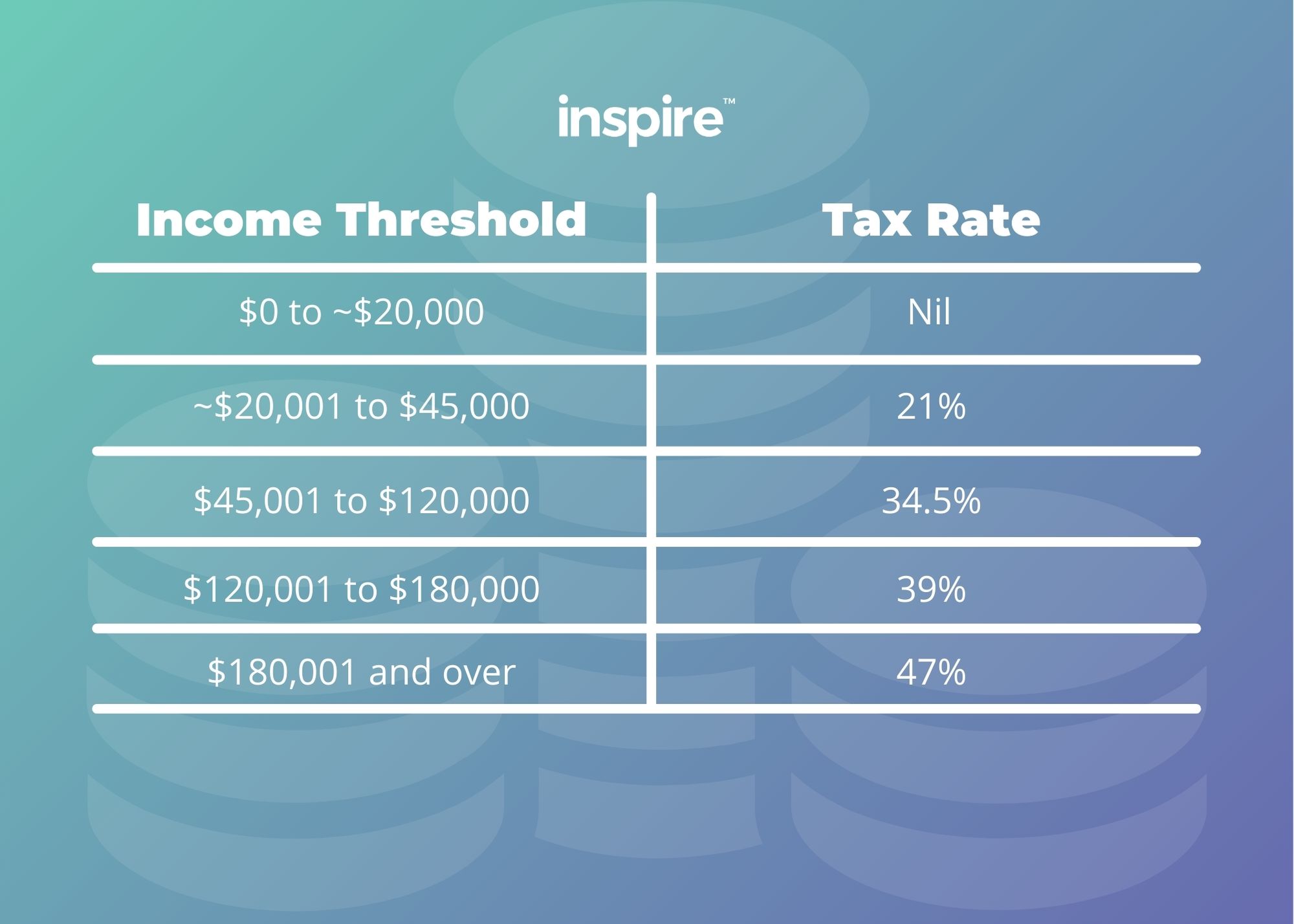

The Top 9 Tax Planning Strategies For High Income Employees Inspire Accountants Small Business Accountants Brisbane

How Can 7 Figure Income Earners Save On Income Taxes Quora

U S Income Tax Policy Is Mostly About The 1 Bloomberg

2022 2023 Tax Brackets Rates For Each Income Level

Tax Reduction Strategies For High Income Individuals In 2021 Youtube

Income Tax Law Changes What Advisors Need To Know

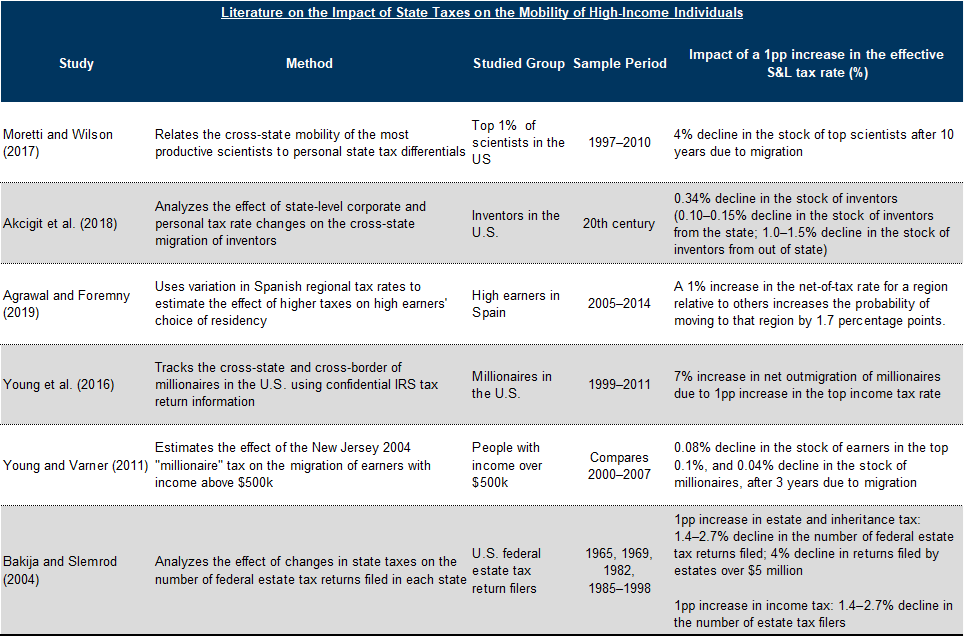

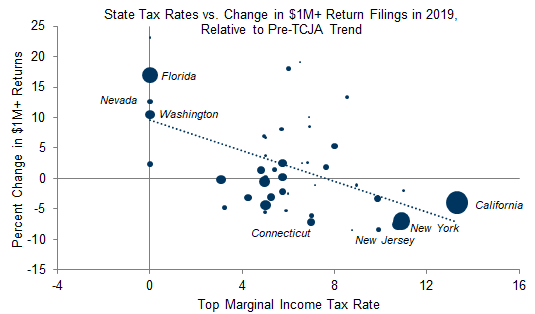

No Taxation Without Emigration Briggs

How Raising Tax For High Income Earners Would Reduce Inequality Improve Social Welfare In New Zealand