iowa lottery tax calculator

This varies across states and can range from 0 to more than 8. If a player wins more than 5000 an.

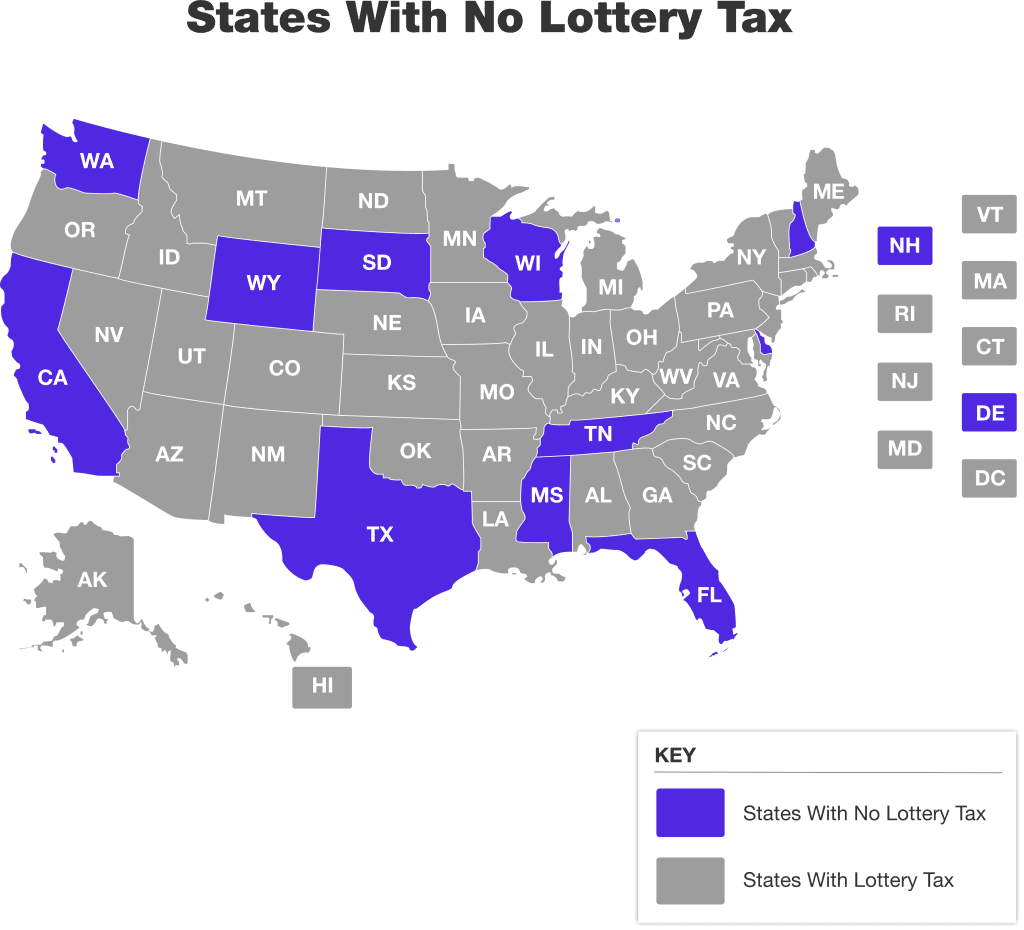

Top 5 Best And Worst States To Win The Lottery

Calculate your lottery lump sum or.

. 23 You must be 21 years or older to play Video Lottery The 10 Best Mass Lottery Scratch Tickets This Month. Additional tax withheld dependent on the state. File returns and make payments Four Iowa Lottery players so far have won the games prize of 25000 a year.

Iowa Lottery Tax Calculator. The Iowa Lottery makes every effort to ensure the accuracy of the winning numbers prize payouts and other information posted on the Iowa Lottery website. 5 Kansas state tax on lottery winnings in the USA.

25 State Tax. This is equal to a percentage of Iowa taxes paid with rates ranging from. The Iowa Lottery does not withhold tax for prizes of 600 or less.

Tuesday Oct 25 2022. The 10 Best Mass Lottery. A federal tax of 24 percent will be taken from all prizes above 5000 including the jackpot before you receive your prize money.

You may then be eligible for a refund or have to pay more. The Iowa tax that must be withheld is computed and. After determining their Iowa state tax liability many Iowa taxpayers must pay a school district surtax.

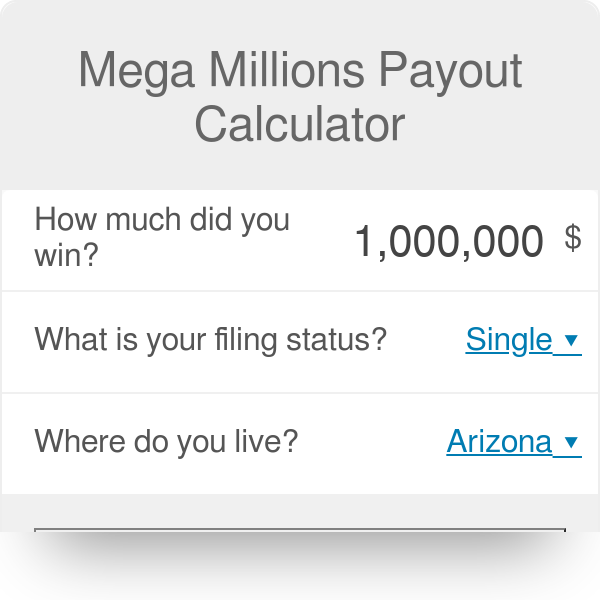

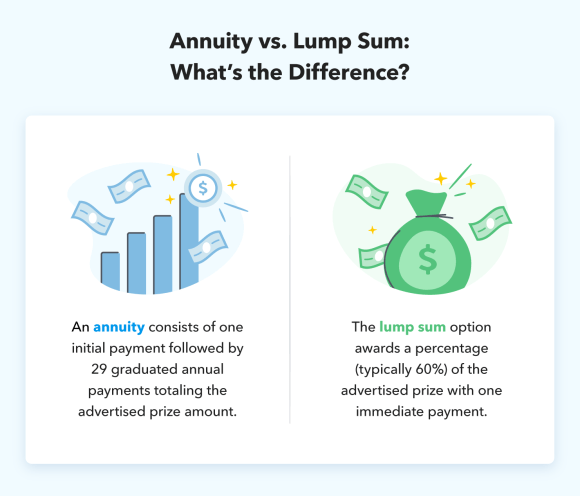

323 Iowa state tax on lottery winnings in the USA. Our Mega Millions calculator takes into account the federal and state tax rates and calculates payouts for both lump-sum cash and annual payment options so you can compare the two. A lottery payout calculator can also calculate how much tax youll pay on your lottery winnings using current tax laws in each state.

Imagine having to pay 28 in taxes on your precious lottery winnings. Calculate the taxes you need to pay if you win the current Powerball jackpot and more importantly how much money you will take home. This also applies to winnings from a multi-state lottery if the tickets were purchased within the state of Iowa.

By law prizes of more than 600 will face a 5 percent state withholding tax. This can range from 24 to 37 of your winnings. Although it sounds like the full lottery taxes applied to players in the.

Iowa Income Tax Calculator - SmartAsset REV-573 -- Property Tax Rent Rebate. Lottery Winning Taxes in India. 495 Indiana 34 Iowa 5.

A lottery payout calculator can also calculate how much tax youll pay on your lottery winnings using current tax laws in each state. Current Mega Millions Jackpot. To understand these complicated lottery tax calculations you need to get your hands on a lottery tax calculator and hire a financial advisor to get help over tax and.

The Tax Calculator helps you to work out how much cash you will receive on your Lotto America prize once federal and state taxes have been deducted. The calculator will display the taxes owed and the net jackpot what you take home after taxes.

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Lottery Tax Calculator Updated 2022 Lottery N Go

How Much Tax Would Be Owed On Mega Millions 1 Billion Ticket

How Much You Ll Pay In Taxes For Mega Millions 1 Billion Jackpot Fortune

Taxes On New York Lotto Winnings

Top 5 Best And Worst States To Win The Lottery

Know How Much Taxes You Will Pay After Winning The Lottery

Mega Millions Payout Calculator

Know How Much Taxes You Will Pay After Winning The Lottery

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Iowa Lottery Ia Results Winning Numbers Fun Facts

Illinois Gambling Winnings Tax Calculator Illinoisbet Com

The 73 Billion In Voluntary Taxes Up 9 Consumers Pay Eagerly And With Great Excitement Wolf Street

Lottery Calculator The Turbotax Blog

Lottery Calculator The Turbotax Blog

Free Gambling Winnings Tax Calculator All 50 Us States